Scenario Modelling Process

Scenario modelling is our way to make sense of a turbulent decade without pretending to predict it. Instead of one “right” future, we develop several plausible paths and ask what would have to be true for each to unfold. This gives investors a clear framework for risk, opportunity, and timing.

What are scenarios?

Scenarios are structured stories about how the world could look by 2035. They are not forecasts. Rather, they help us test assumptions and prepare for surprises. Each scenario begins with a simple question: if a defined set of conditions holds, what does the global order look like in ten years, and how do markets adapt?

To anchor the work, we cross-reference classic guides to scenario planning such as the MIT Sloan Management Review overview of scenario tools and Peter Schwartz’s practitioner playbook, The Art of the Long View. We also scan applied programmes like Shell’s Scenarios to keep our approach practical.

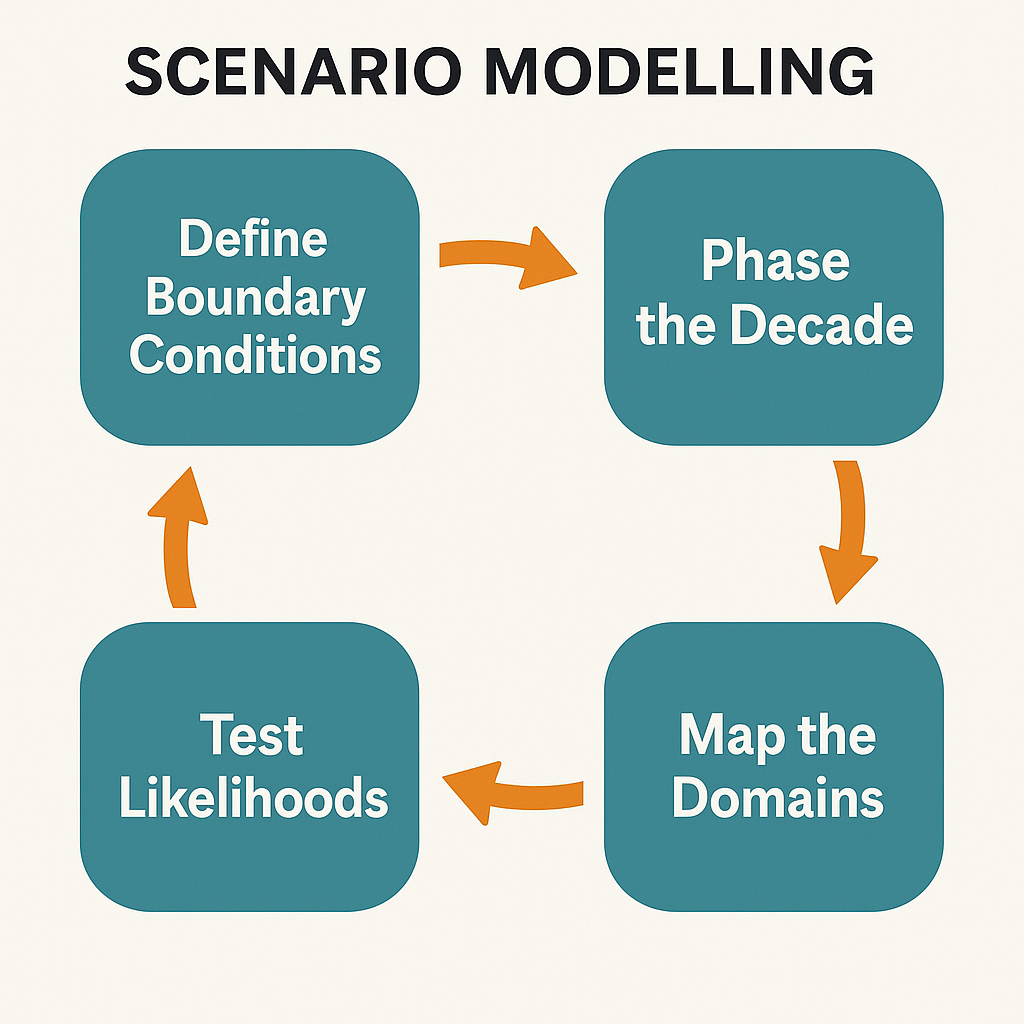

How do we build them?

We start by setting boundary conditions. These are the political, economic, and security assumptions that must remain intact for a scenario to hold. Examples include constitutional stability in the United States, the absence of engineered great-power conflict over Taiwan or the South China Sea, and the continued legitimacy of multilateral forums like the United Nations.

We then phase the decade into early, middle, and late periods, so signals can be tracked over time rather than guessed all at once. Finally, we map each scenario across a common set of themes: currency and finance, security architecture and alliances, global governance, technology and critical commodities, and the investor outlook. This common map lets readers compare scenarios and spot shifts as they happen.

How do we assess likelihood?

We keep the modelling simple and transparent. For each scenario, we list its preconditions, attribute a probability to each one holding through 2025–2035, and assign a weight to reflect its importance. We then combine them using a weighted geometric average and apply a small discount for correlation, because political and security risks rarely move independently. When all four scenarios have a score, we renormalise them so the set adds to 100%.

The result is not an oracle; it is a disciplined way to update our views as new information arrives. As signals improve or deteriorate — for example, if military-to-military hotlines resume, or if a tariff spiral accelerates — we adjust a few inputs by small steps and recompute. Over time this keeps our judgements steady, but responsive.

In practice, the method pairs well with lived market experience. Analysts can test sector exposures against more than one future, and investors can diversify across themes that perform in different scenarios. Readers can also trace internal links between our scenario pages and our investment theses.

References

Schoemaker, P. J. H. (1995). Scenario Planning: A Tool for Strategic Thinking. MIT Sloan Management Review. Available at: https://sloanreview.mit.edu/article/scenario-planning-a-tool-for-strategic-thinking/

Schwartz, P. (1996). The Art of the Long View: Planning for the Future in an Uncertain World. Doubleday. Overview at: https://www.goodreads.com/book/show/107632.The_Art_of_the_Long_View

Shell (n.d.). Shell Scenarios. Available at: https://www.shell.com/energy-and-innovation/the-energy-future/scenarios.html

Archives

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | 31 | |||||